Host-To-Host Integration Guide

Host to Host Integration Guide

You can only use this Integration if you are either

PCI DSS Certified Merchant, sending Card Number for each transaction

or

You have previously tokenized a card using our Payment Integration Guide or DOKU Checkout, sending Token for each transaction

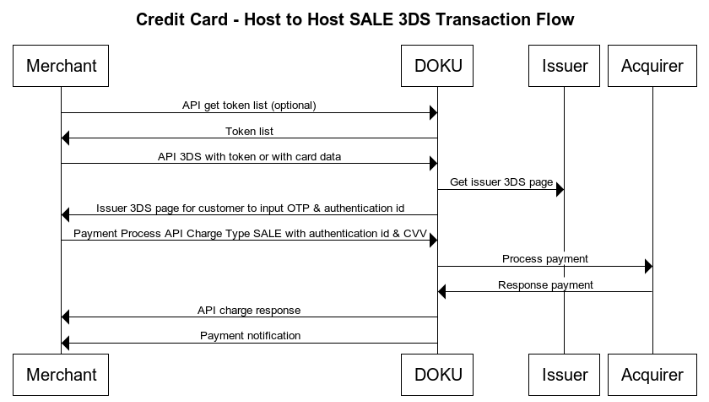

Here is the overview of how to integrate process transaction using H2H API:

Prepare credit card form input / Get token list (Optional)

Hit Check 3DS to Get 3DS authentication ID and 3DS URL (Conditional)

Hit API Charge

Acknowledge payment result

Get Token List is Optional, only needed if you utilize DOKU's tokenization feature where you can send token instead of cards number to avoid security risk by sending sensitive data

Check 3DS Process is Conditional, it is required for payment type SALE, AUTHORIZE, INSTALLMENT but not required for MOTO & RECURRING, you may skip this process and proceed to Charge API

Check 3D Secure

3D Secure (3DS) is an authentication protocol used in online credit card transactions to enhance security and reduce fraud. It requires the cardholder to complete an additional verification step with their issuing bank before the transaction is approved. This process helps confirm that the legitimate cardholder is making the purchase.

API Request

HTTP Method

POST

API endpoint (Sandbox)

https://api-sandbox.doku.com/credit-card/check-three-d-secure

API endpoint (Production)

https://api.doku.com/credit-card/check-three-d-secure

Here is the sample of request header to get 3DS authentication:

Request Header Explanation

Client-Id

Client ID retrieved from DOKU Back Office

Request-Id

Unique random string (max 128 characters) generated from merchant side to protect duplicate request

Request-Timestamp

Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z

Signature

Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature

Here is the sample request body to get 3DS authentication:

Request Body Explanation

order.amount

number

Mandatory

In IDR Currency and without decimal

Allowed chars: numeric

Max length: 12

order.invoice_number

string

Optional

Invoice number of the transaction, if brought use consistent invoice number during charge as well

Recommended to bring

Max length: 64

30 for mandiri

card.token

string

Conditional

Card token generated by DOKU, can be used if you already activate tokenization

either card.token or card.number must be sent

card.number

string

Conditional

Card numbe printed on card either card.token or card.number must be sent

card.expiry

string

Conditional

Card expiry date, can be optional if you sent card.token

Format: MMYY

three_dsecure.callback_url_success

string

Mandatory

After 3DS process success, customer will be redirected to this page

three_dsecure.callback_url_failed

string

Mandatory

After 3DS process success, customer will be redirected to this page

API Response

After hitting the above API request, DOKU will give the response.

HTTP Status

200

Result

SUCCESS

Here is the sample response header:

Response Header Explanation

Client-Id

Same as the request

Request-Id

Same as the request

Response-Timestamp

Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU

Signature

Signature generated by DOKU based on the response body

Here is the sample of successful response body:

Here is the sample of failed response body:

Response Body Explanation

order.amount

number

Mandatory

Same as the request

three_dsecure.enrollment_status

boolean

Mandatory

Card 3D Secure enrollment status

Possible value: true, false

three_dsecure.authentication_id

string

Mandatory

3DS process ID to use on API Charge

three_dsecure.authentication_url

string

Optional

3DS page that need to be opened by customer to fill in the OTP (if challanged by issuer) returned if the three_dsecure.enrollment_status is true

three_dsecure.three_ds_version

string

Optional

3DS Version used to authenticate, value would be something like "2.x" or "2.x.x"

Charge API

After the customer is redirected to the 3DS success page, then your backend must trigger the API Charge to DOKU:

API Request

HTTP Method

POST

API endpoint (Sandbox)

https://api-sandbox.doku.com/credit-card/charge

API endpoint (Production)

https://api.doku.com/credit-card/charge

Here is the sample of request header to charge the transaction:

Request Header Explanation

Client-Id

Client ID retrieved from DOKU Back Office

Request-Id

Unique random string (max 128 characters) generated from merchant side to protect duplicate request

Request-Timestamp

Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z

Signature

Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature

Here is the sample request body to charge the transaction:

If you have your own 3DS Authenticator processor you can use our MPI (Merchant Plug-in) Feature by sending additional Authentication object like example below, note that this feature is not available for all merchant, please consult with DOKU team first.

Request Body Explanation

order.amount

number

Mandatory

In IDR Currency and without decimal

Allowed chars: numeric

Max length: 12

order.invoice_number

string

Mandatory

Invoice number of the transaction, if brought use consistent invoice number during charge as well

Recommended to bring

Max length: 64

30 for Acquirer Mandiri

order.descriptor

String

Optional

Custom string to be printed on Customer's billing statement

Max length: 22

need to be activated, please consult DOKU team first

order.line_items.name

string

Optional

Name of the product item

Allowed chars: alphabetic, numeric, special chars

Max Length: 255

order.line_items.price

number

Optional

Price of the product item. Total price and quantity must match with the order.amount

Allowed chars: numeric

Max Length: 12

order.line_items.quantity

number

Optional

Quantity of the product item

Allowed chars: numeric

Max Length: 4

customer.id

string

Conditional

Unique customer identifier generated by merchant. Mandatory if merchant wants to use tokenization feature.

Allowed chars: alphabetic, numeric, special chars

Max Length: 50

customer.name

string

Optional

Customer name

Allowed chars: alphabetic

Max Length: 255

customer.email

string

Optional

Customer email

Allowed chars: alphabetic, numeric, special chars

DO NOT SEND STATIC/DUMMY VALUE

Max Length: 128

customer.phone

string

Optional

Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455

Allowed chars: numeric

Max Length: 16

customer.address

string

Optional

Customer address

Allowed chars: alphabetic, numeric, special chars

Max Length: 400

customer.country

string

Optional

2 alphabetic country code ISO 3166-1

Allowed chars: alphabetic

Min-max Length: 2

three_dsecure.authentication_id

string

Conditional

Mandatory if 3DS transaction, Obtained from Check 3DS API

authentication.version

string

Optional

version of the 3ds authentication example: 3DS2

authentication.3ds.eci

string

Optional

a code provided by a indicating the outcome of the authentication attempt, bring for MPI 3DS

Allowed chars: numeric

Min-max Length: 2

authentication.3ds.xid

string

Optional

a unique identifier associated with a specific transaction in the 3D Secure (3DS) authentication process, bring for MPI 3DS

Allowed chars: numeric

Min-max Length: 20

authentication.3ds.cavv

string

Optional

a cryptographic value that links the issuer's authentication, bring for MPI 3DS

Allowed chars: alphanumeric

Min-max Length: 1024

authentication.3ds.status

string

Optional

outcome of the 3D Secure (3DS) authentication process, Y/N

Allowed chars: alphabhetic

Min-max Length: 1

authentication.3ds.ds_transaction_id

string

Optional

outcome of the 3D Secure (3DS) authentication process, Y/N

Allowed chars: alpabethic, numberic, symbols

Min-max Length: 128

payment.type

string

Mandatory

Payment type

Possible value :SALE, A MOTO,AUTHJORIZE,

payment.plan_id

string

Optional

Promotion ID from the bank for merchant

card.token

string

Optional

Card token generated by DOKU, for 3ds transaction please bring three_dsecure.authentication_id only

card.number

string

Mandatory

Card number, can be optional if you sent card.token

card.expiry

string

Mandatory

Card expiry date, can be optional if you sent card.token

Format: MMYY

card.cvv

string

Mandatory

Card CVV, Optional if payment.type is MOTO

card.save

boolean

Optional

Set true if you want to force customer to save the card token for the next payment

Possible value: true, false

Default value: false

API Response

After hitting the above API request, DOKU will give the response.

HTTP Status

200

Result

SUCCESS

Here is the sample response header:

Response Header Explanation

Client-Id

Same as the request

Request-Id

Same as the request

Response-Timestamp

Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU

Signature

Signature generated by DOKU based on the response body

Here is the sample of response body:

Here is the sample of response body: - Rejected by Banks

Here is the sample of response body: - Invalid Parameters

Response Body Explanation

order.invoice_number

string

Mandatory

Same as the request

order.amount

number

Mandatory

Same as the request

customer.id

string

Optional

Same as the request

payment.type

string

Mandatory

Same as the request

payment.identifier.name

string

Mandatory

Additional payment info name

payment.identifier.value

string

Mandatory

Additional payment info value

payment.request_id

string

Mandatory

Request ID sent on merchant's request header

payment.authorize_id

string

Conditional

Authorize ID for authorize-capture transaction. Mandatory if payment.type is AUTHORIZE

payment.response_code

string

Mandatory

Reponse code generated by DOKU / Acquirer

payment.response_message

string

Mandatory

Response message generated by DOKU / Acquirer

payment.status

string

Mandatory

Payment status

Possible value: SUCCESS, FAILED, PENDING

payment.eci

string

Mandatory

ECI for this transaction

payment.approval_code

string

Optional

Approval code for success transaction generated by acquirer

three_dsecure.authentication_id

string

Mandatory

Same as the request

card.masked

string

Optional

Card masked number

card.type

string

Mandatory

Card type

Possible value: CREDIT, DEBIT

card.issuer

string

Mandatory

Card issuer

card.brand

string

Mandatory

Principal brand

VISA, MASTER, JCB, AMEX

card.token

string

Optional

Card token generated by DOKU if card.save is true

INFO

You can check the list of possible response code and how to handle them here

4. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

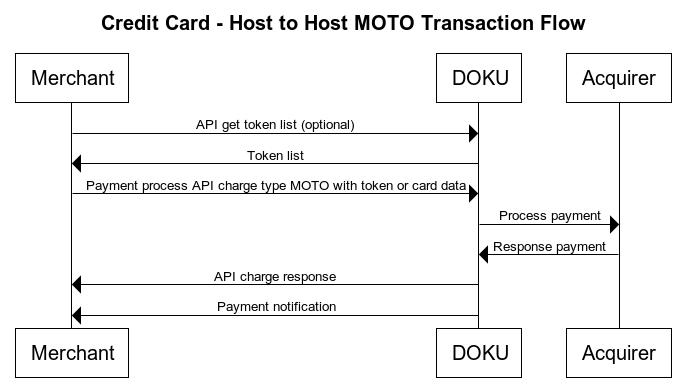

MOTO & Recurring Payment Type

Here is the overview of how to integrate MOTO & Recurring payment type:

Prepare credit card form input / Get token list (Optional)

Hit API Charge

Acknowledge payment result

1. Prepare credit card form input / Get token list (Optional)

You can create credit card form input on your end, so that your customer can input their credit card number, expiry date, and CVV.

If you save the card token from DOKU side, you can use Get Token List show the saved card of your customers.

2. Hit API Charge

After the customer input the credit card, then your backend must trigger the API Charge to DOKU:

API Request

HTTP Method

POST

API endpoint (Sandbox)

https://api-sandbox.doku.com/credit-card/charge

API endpoint (Production)

https://api.doku.com/credit-card/charge

Here is the sample of request header to charge the transaction:

Request Header Explanation

Client-Id

Client ID retrieved from DOKU Back Office

Request-Id

Unique random string (max 128 characters) generated from merchant side to protect duplicate request

Request-Timestamp

Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z

Signature

Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature

Here is the sample request body for MOTO transaction:

Here is the sample request body for 1st Recurring transaction:

Here is the sample request body for 2nd Recurring transaction:

if needed billing.billing_transaction_id will be returned by DOKU in the API Response in the 1st Payment

If returned, Merchant must save the value and send it in billing.billing_transaction_id in the request body for the 2nd transaction and onwards

Request Body Explanation

order.amount

number

Mandatory

In IDR Currency and without decimal

Allowed chars: numeric

Max length: 12

order.invoice_number

string

Mandatory

Generated by merchant to identify the order

Allowed chars: alphabetic, numeric, special chars

Max length: 64

30 for Acquirer Mandiri

order.descriptor

string

Optional

Custom string to be printed on Customer's billing statement

Max length: 22

need to be activated, please consult DOKU team first

order.line_items.name

string

Optional

Name of the product item

Allowed chars: alphabetic, numeric, special chars

Max Length: 255

order.line_items.price

number

Optional

Price of the product item. Total price and quantity must match with the order.amount

Allowed chars: numeric

Max Length: 12

order.line_items.quantity

number

Optional

Quantity of the product item

Allowed chars: numeric

Max Length: 4

customer.id

string

Conditional

Unique customer identifier generated by merchant. Mandatory if merchant wants to use tokenization feature.

Allowed chars: alphabetic, numeric, special chars

Max Length: 50

customer.name

string

Optional

Customer name

Allowed chars: alphabetic

Max Length: 255

customer.email

string

Optional

Customer email

Allowed chars: alphabetic, numeric, special chars

Max Length: 128

customer.phone

string

Optional

Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455

Allowed chars: numeric

Max Length: 16

customer.address

string

Optional

Customer address

Allowed chars: alphabetic, numeric, special chars

Max Length: 400

customer.country

string

Optional

2 alphabetic country code ISO 3166-1

Allowed chars: alphabetic

Min-max Length: 2

payment.type

string

Mandatory

Payment type

Possible value: SALE, AUTHORIZE, INSTALLMENT, MOTO, RECURRING

card.token

string

Conditional

Token generated by DOKU

Either card.token or card.number is mandatory (only 1 needed)

card.number

string

Conditional

Card number (PAN)

Either card.token or card.number is mandatory (only 1 needed)

card.expiry

string

Conditional

Card expiry date, not needed if you sent card.token

Format: MMYY

card.save

boolean

Optional

Set true if you are using card.number andwant to tokenize the card for the next payment

Possible value: true, false

Default value: false

billing.amount_variability

string

Conditional

Indicates if all the payments within the agreement use the same amount or if the amount differs between the payments.

Possible value

FIXED, VARIABLE

Default value: false

billing.billing_number

string

Conditional

Unique identifier of the billing transaction

Max Length: 23

billing.number_of_payment

number

Conditional

The current number of payment paid for the billing number

billing.payment_frequency

string

Conditional

The frequency of the payments within the series as agreed with the payer under your agreement with them.

Possible value

MONTHLY, DAILY,WEEKLY,YEARLY,OTHER

billing.billing_transaction_id

string

Conditional

Only applicable for Mandiri Acquirer

Unique identifier of the billing transaction, If DOKU returned this on 1st payment response need to be forwarded from second payment onward, otherwise optional

Max Length: 100

API Response

After hitting the above API request, DOKU will give the response.

HTTP Status

200

Result

SUCCESS

Here is the sample response header:

Response Header Explanation

Client-Id

Same as the request

Request-Id

Same as the request

Response-Timestamp

Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU

Signature

Signature generated by DOKU based on the response body

Here is the sample of MOTO response body:

Here is the sample of Recurring response body:

Response Body Explanation

order.invoice_number

string

Mandatory

Same as the request

order.amount

number

Mandatory

Same as the request

customer.id

string

Optional

Same as the request

payment.type

string

Mandatory

Same as the request

payment.identifier.name

string

Mandatory

Additional payment info name

payment.identifier.value

string

Mandatory

Additional payment info value

payment.request_id

string

Mandatory

Request ID sent on merchant's request header

payment.authorize_id

string

Optional

Authorize ID for authorize transaction. Mandatory if payment.type is AUTHORIZE

payment.response_code

string

Mandatory

Reponse code generated by DOKU / Acquirer

payment.response_message

string

Mandatory

Response message generated by DOKU / Acquirer

payment.status

string

Mandatory

Payment status

Possible value: SUCCESS, FAILED, PENDING

payment.eci

string

Mandatory

ECI for this transaction

payment.approval_code

string

Optional

Approval code for success transaction generated by acquirer

card.masked

string

Optional

Card masked number

card.type

string

Mandatory

Card type

Possible value: CREDIT, DEBIT

card.issuer

string

Mandatory

Card issuer

card.brand

string

Mandatory

Principal brand

VISA, MASTER, JCB, AMEX

card.token

string

Optional

Card token generated by DOKU if card.save is true

billing.billing_number

string

Conditional

Unique identifier of the billing transaction

Max Length: 23

billing.number_of_payment

number

Conditional

The current number of payment paid for the billing number

billing.billing_transaction_id

string

Conditional

Only applicable for Mandiri Acquirer

Unique identifier of the billing transaction, If DOKU returned this on 1st payment response need to be forwarded from second payment onward, otherwise optional

Max Length: 100

billing.amount_variability

string

Conditional

Same as request

billing.payment_frequency

string

Conditional

Same as request

3. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

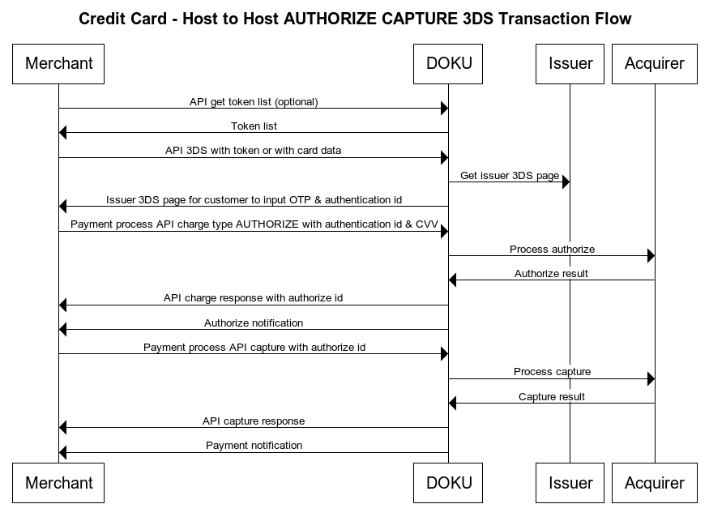

Here is the overview of how to integrate AUTHORIZE CAPTURE payment:

Prepare credit card form input / Get token list

Get 3DS authentication ID and 3DS URL

Hit API Charge

Hit API Capture

Acknowledge payment result

1. Prepare credit card form input / Get token list

You can create credit card form input on your end, so that your customer can input their credit card number, expiry date, and CVV.

If you save the card token from DOKU side, you can use Tokenization to show the saved card of your customers.

2. Get 3DS authentication ID and 3DS URL

To get 3DS authentication, you will need to hit this API through your backend:

API Request

HTTP Method

POST

API endpoint (Sandbox)

https://api-sandbox.doku.com/credit-card/check-three-d-secure

API endpoint (Production)

https://api.doku.com/credit-card/check-three-d-secure

Here is the sample of request header to get 3DS authentication:

Request Header Explanation

Client-Id

Client ID retrieved from DOKU Back Office

Request-Id

Unique random string (max 128 characters) generated from merchant side to protect duplicate request

Request-Timestamp

Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z

Signature

Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature

Here is the sample request body to get 3DS authentication:

Request Body Explanation

order.amount

number

Mandatory

In IDR Currency and without decimal

Allowed chars: numeric

Max length: 12

card.token

string

Optional

Card token generated by DOKU, can be used if you already activate tokenization

card.number

string

Mandatory

Card number, can be optional if you sent card.token

card.expiry

string

Mandatory

Card expiry date, can be optional if you sent card.token

Format: MMYY

three_dsecure.callback_url_success

string

Mandatory

After 3DS process success, customer will be redirected to this page

three_dsecure.callback_url_failed

string

Mandatory

After 3DS process success, customer will be redirected to this page

API Response

After hitting the above API request, DOKU will give the response.

HTTP Status

200

Result

SUCCESS

Here is the sample response header:

Response Header Explanation

Client-Id

Same as the request

Request-Id

Same as the request

Response-Timestamp

Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU

Signature

Signature generated by DOKU based on the response body

Here is the sample of response body:

Response Body

order.amount

number

Mandatory

Same as the request

three_dsecure.enrollment_status

boolean

Mandatory

Card 3D Secure enrollment status

Possible value: true, false

three_dsecure.authentication_id

string

Mandatory

3DS process ID to use on API Charge

three_dsecure.authentication_url

string

Optional

3DS page if the three_dsecure.enrollment_status is true

3. Hit API Charge

After the customer is redirected to the 3DS success page, then your backend must trigger the API Charge to DOKU:

API Request

HTTP Method

POST

API endpoint (Sandbox)

https://api-sandbox.doku.com/credit-card/charge

API endpoint (Production)

https://api.doku.com/credit-card/charge

Here is the sample of request header to charge the transaction:

Request Header Explanation

Client-Id

Client ID retrieved from DOKU Back Office

Request-Id

Unique random string (max 128 characters) generated from merchant side to protect duplicate request

Request-Timestamp

Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z

Signature

Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature

Here is the sample request body to charge the transaction:

Request Body Explanation

order.amount

number

Mandatory

In IDR Currency and without decimal

Allowed chars: numeric

Max length: 12

order.invoice_number

string

Mandatory

Generated by merchant to identify the order

Allowed chars: alphabetic, numeric, special chars

Max length: 64

30 for Acquirer Mandiri

order.line_items.name

string

Optional

Name of the product item

Allowed chars: alphabetic, numeric, special chars

Max Length: 255

order.line_items.price

number

Optional

Price of the product item. Total price and quantity must match with the order.amount

Allowed chars: numeric

Max Length: 12

order.line_items.quantity

number

Optional

Quantity of the product item

Allowed chars: numeric

Max Length: 4

customer.id

string

Conditional

Unique customer identifier generated by merchant. Mandatory if merchant wants to use tokenization feature.

Allowed chars: alphabetic, numeric, special chars

Max Length: 50

customer.name

string

Optional

Customer name

Allowed chars: alphabetic

Max Length: 255

customer.email

string

Optional

Customer email

Allowed chars: alphabetic, numeric, special chars

DO NOT SEND STATIC/DUMMY VALUE

Max Length: 128

customer.phone

string

Optional

Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455

Allowed chars: numeric

Max Length: 16

customer.address

string

Optional

Customer address

Allowed chars: alphabetic, numeric, special chars

Max Length: 400

customer.country

string

Optional

2 alphabetic country code ISO 3166-1

Allowed chars: alphabetic

Min-max Length: 2

three_dsecure.authentication_id

string

Conditional

Mandatory if 3DS transaction, Obtained from Check 3DS API

authentication.threeDS.eci

string

Optional

a code provided by a indicating the outcome of the authentication attempt, bring for MPI 3DS

Allowed chars: numeric

Min-max Length: 2

authentication.threeDS.xid

string

Optional

a unique identifier associated with a specific transaction in the 3D Secure (3DS) authentication process, bring for MPI 3DS

Allowed chars: numeric

Min-max Length: 20

authentication.threeDS.cavv

string

Optional

a cryptographic value that links the issuer's authentication, bring for MPI 3DS

Allowed chars: alphanumeric

Min-max Length: 1024

authentication.threeDS.status

string

Optional

outcome of the 3D Secure (3DS) authentication process, Y/N

Allowed chars: alphabhetic

Min-max Length: 1

authentication.threeDS.dsTransactionId

string

Optional

outcome of the 3D Secure (3DS) authentication process, Y/N

Allowed chars: alpabethic, numberic, symbols

Min-max Length: 128

payment.type

string

Mandatory

Payment type

Possible value: SALE, MOTO, AUTHORIZE

payment.plan_id

string

Optional

Promotion ID from the bank for merchant

card.token

string

Optional

Card token generated by DOKU, for 3ds transaction please bring three_dsecure.authentication_id only

card.number

string

Mandatory

Card number, can be optional if you sent card.token

card.expiry

string

Mandatory

Card expiry date, can be optional if you sent card.token

Format: MMYY

card.cvv

string

Mandatory

Card CVV, Optional if payment.type is MOTO

card.save

boolean

Optional

Set true if you want to force customer to save the card token for the next payment

Possible value: true, false

Default value: false

API Response

After hitting the above API request, DOKU will give the response.

HTTP Status

200

Result

SUCCESS

Here is the sample response header:

Response Header Explanation

Client-Id

Same as the request

Request-Id

Same as the request

Response-Timestamp

Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU

Signature

Signature generated by DOKU based on the response body

Here is the sample of response body:

Response Body Explanation

order.invoice_number

string

Mandatory

Same as the request

order.amount

number

Mandatory

Same as the request

customer.id

string

Optional

Same as the request

payment.type

string

Mandatory

Same as the request

payment.identifier.name

string

Mandatory

Additional payment info name

payment.identifier.value

string

Mandatory

Additional payment info value

payment.request_id

string

Mandatory

Request ID sent on merchant's request header

payment.authorize_id

string

Mandatory

Authorize ID for authorize transaction. Mandatory if payment.type is AUTHORIZE

payment.response_code

string

Mandatory

Reponse code generated by DOKU / Acquirer

payment.response_message

string

Mandatory

Response message generated by DOKU / Acquirer

payment.status

string

Mandatory

Payment status

Possible value: SUCCESS, FAILED, PENDING

payment.eci

string

Mandatory

ECI for this transaction

payment.approval_code

string

Optional

Approval code for success transaction generated by acquirer

three_dsecure.authentication_id

string

Mandatory

Same as the request

card.masked

string

Optional

Card masked number

card.type

string

Mandatory

Card type

Possible value: CREDIT, DEBIT

card.issuer

string

Mandatory

Card issuer

card.brand

string

Mandatory

Principal brand

VISA, MASTER, JCB, AMEX

card.token

string

Optional

Card token generated by DOKU if card.save is true

DOKU will also send the HTTP Notification with the payment.authorize_id to your defined Notification URL.

4. Hit API Capture

After you get the payment.authorize_id, then your backend must trigger the API Charge to DOKU:

API Request

HTTP Method

POST

API endpoint (Sandbox)

https://api-sandbox.doku.com/credit-card/capture

API endpoint (Production)

https://api.doku.com/credit-card/capture

Here is the sample of request header to capture the transaction:

Request Header Explanation

Client-Id

Client ID retrieved from DOKU Back Office

Request-Id

Unique random string (max 128 characters) generated from merchant side to protect duplicate request

Request-Timestamp

Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z

Signature

Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature

Here is the sample request body to capture the transaction:

Request Body Explanation

payment.authorize_id

string

Mandatory

Authorize ID from the Charge API Response / HTTP Notification

payment.capture_amount

string

Optional

The value of transactions which will be paid by the customer. If undefined, capture full transaction.

API Response

After hitting the above API request, DOKU will give the response.

HTTP Status

200

Result

SUCCESS

Here is the sample response header:

Response Header Explanation

Client-Id

Same as the request

Request-Id

Same as the request

Response-Timestamp

Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU

Signature

Signature generated by DOKU based on the response body

Here is the sample of response body:

Response Body Explanation

order.invoice_number

string

Mandatory

Same as the request

order.amount

number

Mandatory

Same as the request

customer.id

string

Optional

Same as the request

payment.type

string

Mandatory

Same as the request

payment.identifier.name

string

Mandatory

Additional payment info name

payment.identifier.value

string

Mandatory

Additional payment info value

payment.request_id

string

Mandatory

Request ID sent on merchant's request header

payment.authorize_id

string

Mandatory

Authorize ID for authorize transaction. Mandatory if payment.type is AUTHORIZE

payment.response_code

string

Mandatory

Reponse code generated by DOKU / Acquirer

payment.response_message

string

Mandatory

Response message generated by DOKU / Acquirer

payment.status

string

Mandatory

Payment status

Possible value: SUCCESS, FAILED, PENDING

payment.eci

string

Mandatory

ECI for this transaction

payment.approval_code

string

Optional

Approval code for success transaction generated by acquirer

three_dsecure.authentication_id

string

Mandatory

Same as request, obtained from three

card.masked

string

Optional

Card masked number

card.type

string

Mandatory

Card type

Possible value: CREDIT, DEBIT

card.issuer

string

Mandatory

Card issuer

card.brand

string

Mandatory

Principal brand

VISA, MASTER, JCB, AMEX

card.token

string

Optional

Card token generated by DOKU if card.save is true

5. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

List of Error Code

If something happens, you can see the following error code to find out what error is happening :

Check-three-d-secure

Invalid Client-Id

invalid_client_id

400

Invalid Client ID

Check-three-d-secure

Header Client-Id is required

invalid_header_request

400

empty client id

Check-three-d-secure

Invalid Header Signature

invalid_signature

400

Payment charge with invalid signature

Check-three-d-secure

Invalid CC Number LENGTH

INVALID_PARAMETER

400

Invalid CC Number LENGTH

Check-three-d-secure

Luhn Validation

INVALID_PARAMETER

400

Card number not valid

Check-three-d-secure

Expiry Date Validation

INVALID_PARAMETER

400

Invalid expiry date 2525

Check-three-d-secure

This field is required.,This merchant does not have three d secure configuration

INVALID_PARAMETER

400

invalid configuration / haven't 3ds mid

Check-three-d-secure

This card is not support three d secure

THREE_D_SECURE_AUTHENTICATION_FAILED

400

card not support 3ds / cannot connect to mpi

Charge

Invalid Client-Id

invalid_client_id

400

Invalid Client ID

Charge

empty client id

invalid_header_request

400

empty client id

Charge

size must be between 1 and 128

invalid_header_request

400

Payment charge with client id length more than max

Charge

Invalid format Header Request-Timestamp

invalid_header_request

400

Payment charge with invalid format request timestamp

Charge

Header Request-Timestamp is not in +- 10 second of now

invalid_header_request

400

Payment charge with request timestamp < now

Charge

Header Request-Timestamp is not in +- 10 second of now

invalid_header_request

400

Payment charge with request timestamp > now

Charge

Invalid Header Signature

invalid_signature

400

Payment charge with invalid signature

Charge

Invalid Header Signature

invalid_signature

400

Payment charge using signature has been used

Charge

Invalid Format Email

INVALID_PARAMETER

400

Payment charge with invalid format email

Charge

Invalid amount

INVALID_PARAMETER

400

Payment charge with amount contain comma

Charge

Invalid amount

INVALID_PARAMETER

400

Payment charge with amount contain dot

Charge

Expiry Date Validation

INVALID_PARAMETER

400

Payment charge with format expiry is YYMM

Charge

Expiry Date Validation

INVALID_PARAMETER

400

Payment charge with expiry date is expired

Charge

Invalid AuthenticationId.

INVALID_PARAMETER

400

invalid authentication_id

Charge

Country Is Not Exists

INVALID_PARAMETER

400

Payment charge with invalid country

Charge

Invalid CC Number LENGTH

INVALID_PARAMETER

400

Invalid CC Number LENGTH

Charge

Luhn Validation

INVALID_PARAMETER

400

Card number not valid

Charge

REQUEST ID IS NOT VALID

INVALID_PARAMETER

400

Payment charge with request id has been used for transaction

Charge

Unauthorized Transaction

MID_TID_NOT_EXIST

400

Payment charge sale using card rejected

Charge

Invalid Authentication Id

INVALID_PARAMETER

400

Invalid Authentication Id

Charge

Invalid Authentication Id

INVALID_PARAMETER

400

Different amount check 3ds & charge

Charge

Invalid Authentication Id

INVALID_PARAMETER

400

Three D Secure Process Not Yet Done (Not yet send OTP)

Charge

Line item 1 quantity must be not empty

INVALID_PARAMETER

400

Invalid line item (quantity is null)

Charge

Your transaction is detected to be concurrent, please create another transaction

DOUBLE_REQUEST_DETECTED

400

Concurent Request

Charge

Conflict

INVALID_PARAMETER

409

duplicate request with same request body

Charge

Precondition failed

INVALID_PARAMETER

412

duplicate request with different request body

Capture

Invalid Client-Id

invalid_client_id

400

Invalid Client ID

Capture

Header Client-Id is required

invalid_header_request

400

empty client id

Capture

Invalid Header Signature

invalid_signature

400

Payment charge with invalid signature

Capture

Authorize Id Must Not Be Blank

INVALID_PARAMETER

400

authorize_id is null

Capture

Failed Get Transaction

TRANSACTION_NOT_FOUND

400

Invalid authorize_id

Capture

Conflict

INVALID_PARAMETER

409

duplicate request with same request body

Capture

Precondition failed

INVALID_PARAMETER

412

duplicate request with different request body

Last updated